Key points

– The theory is that inflation expectations influence future actual realised inflation.

– Central banks pay close attention to inflation expectations, especially in the recent period of high inflation, out of concern that inflation expectations will become “unanchored” and lead to prolonged high inflation.

– But, recent RBA research showed that consumers have a relatively low understanding of the RBA’s 2-3% inflation target, with the unemployed, females and those not engaged with economic news the least likely to know the RBA’s inflation target.

– Measured short-term consumer inflation expectations also massively overstate actual inflation outcomes and bounce around a lot, reflecting changes in volatile items like petrol.

– Market derived measures are a better guide to actual inflation outcomes and remain well anchored in Australia, indicating that the RBA inflation target remains credible.

– The RBA needs to build better community understanding of inflation and the inflation target, to be able to better influence consumer spending decisions through monetary policy.

Introduction

In recent years, central banks have been increasingly focused on inflation expectations. Fears that inflation expectations will become “unanchored” (which means deviate too far from the inflation target) and lead to prolonged high inflation has been one reason behind the aggressive stance on inflation through numerous interest rate increases across global central banks. But some interesting research in the Reserve Bank of Australia Bulletin recently shows that consumers may not have a strong understanding around the RBA’s inflation target which challenges the importance of consumer inflation expectations.

Economic literacy around the RBA inflation target

Our prior work on financial literacy indicated the need to lift levels of financial literacy in Australia, in particular for the gender financial literacy gap. The RBA recently looked into the public’s understanding of the inflation target and inflation expectations as a test of economic and financial literacy.

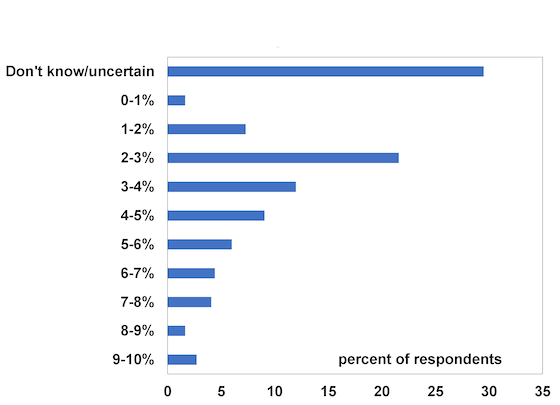

The RBA’s primary function is to keep consumer price inflation between 2 3% per annum. When the RBA surveyed 3000 consumers, it found that just over 20% of respondents knew that the inflation target was between 2 3% (see the chart below), 40% were in the correct ballpark (answering either 1-2%, 2-3% or 3-4%), 30% did not know where the inflation target was and 30% of respondents gave an incorrect answer. Similar outcomes were observed overseas, with a study in the US finding that less than 20% of households could correctly identify the Federal Reserve’s 2% inflation target.

Consumer survey: What is the RBA’s inflation target?

Source: RBA, AMP

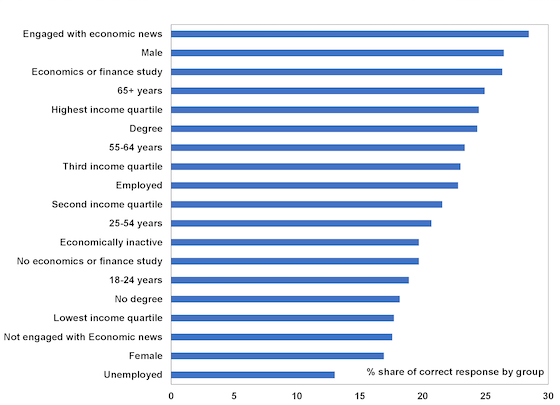

The RBA’s research also found that the socio-demographic groups that were most accurate in their knowledge around the inflation target were either engaged with economic news, male or had studied finance or economics. The groups least likely to be correct were those not engaged with economic news, female or unemployed – see the chart below.

Who knows the inflation target?

Source: RBA, AMP

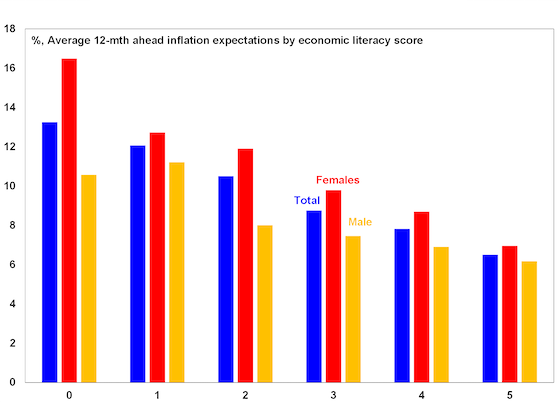

According to the RBA, there was a strong link between reported inflation expectations and the assessed level of economic literacy. Those with low levels of financial literacy had very high expectations of inflation. As financial literacy increased, inflation expectations were lower (and closer to the 2-3% inflation target). Females also consistently overestimated inflation, relative to males across all scores of economic literacy – see the next chart.

Economic Literacy Score and Inflation Expectations

Source: RBA, AMP

The low level of understanding of the RBA’s inflation goals means that readings on consumer inflation expectations may not be particularly reliable, especially as a tool for the RBA to assess monetary policy implications.

Measuring inflation expectations

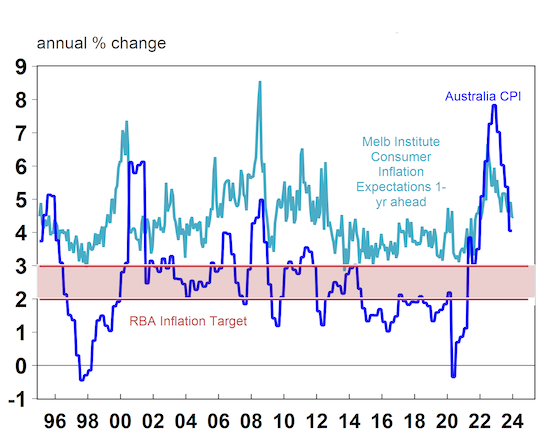

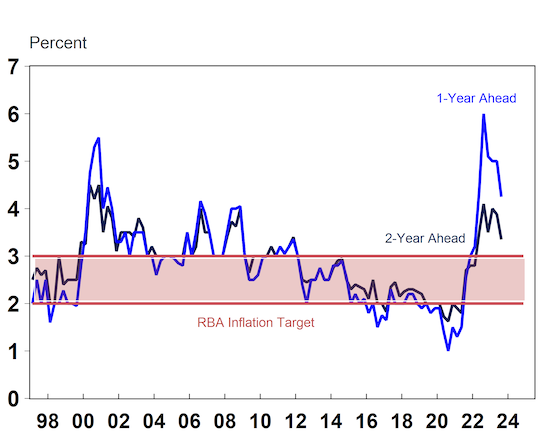

The focus on inflation expectations started in the 1970’s off the back of the rational expectations revolution. The theory is that inflation expectations influence future actual realised inflation. For example, if consumers expect a rise in inflation, they may ask for a commensurate increase in pay, which leads to higher inflation. According to a Melbourne Institute survey of 1-year ahead consumer inflation expectations, consumers tend to severely overstate actual inflation (see the chart below) and inflation expectations also mostly reflect current inflation trends.

Australia Consumer Inflation Expectations

Source: Macrobond, AMP

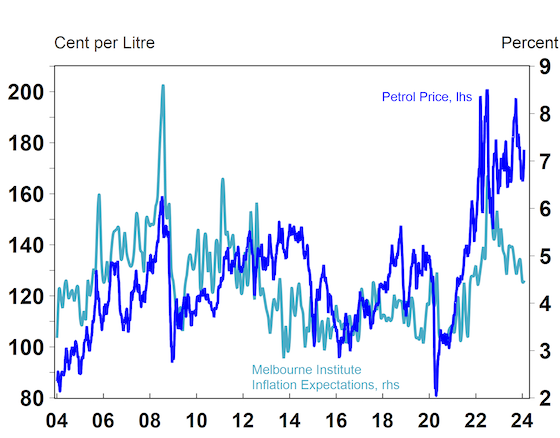

Consumer inflation expectations also bounce around a lot, reflecting changes in the price of volatile items like petrol (see the chart below).

Inflation Expectations and Petrol Prices

Source: Macrobond, AMP

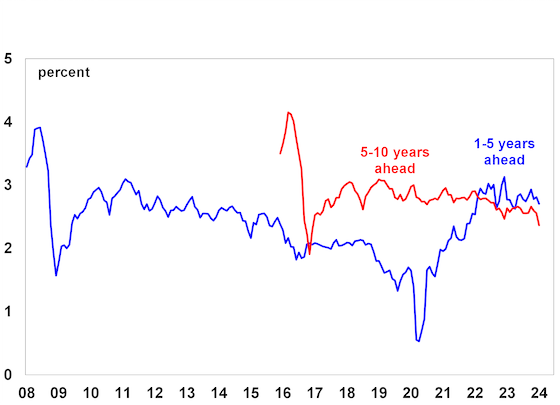

There are also market-based measures of inflation expectations, which can be derived from instruments like break-even inflation rates and inflation linked swaps that hedge for inflation. Inflation indexed swaps show that expectations for 1-5 year ahead inflation lifted significantly over 2021-23 but have settled now at 2.7%. And longer-term inflation expectations (5-10 years) have been relatively stable around 2.5% and most recently declining below 2.4%, indicating confidence in the RBA’s 2-3% inflation target.

Market-based inflation expectations (inflation swaps)

Source: Bloomberg, AMP

Union inflation expectations are important for an important gauge inflation because they set the expectations for award wages and Enterprise Bargaining Agreements. One-year union wage expectations spiked in 2023 (see the chart below) and are still high but are declining which indicates some moderation in wages growth this year.

Australia – Union Inflation Expectations

Source: Macrobond, AMP

Implications for monetary policy

The low level of community understanding around the RBA’s inflation target and unreliable inflation expectations mean that consumer inflation expectations may not be a reliable predictor of actual inflation outcomes. Market and union inflation expectations are better guides to future inflation. It is important for central banks to build community knowledge around inflation, how it’s measured and the RBA’s inflation target, to be able to better influence consumer decisions through monetary policy given the low community understanding around these issues. The lower understanding of the RBA’s inflation goals for females again highlights the need to lift financial and economic literacy in this demographic.

Source: AMP February 2024

Important:

This information is provided by AMP Life Limited. It is general information only and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances and the relevant Product Disclosure Statement or Terms and Conditions, available by calling 07 3245 3438, before deciding what’s right for you.

All information in this article is subject to change without notice. Although the information is from sources considered reliable, AMP and our company do not guarantee that it is accurate or complete. You should not rely upon it and should seek professional advice before making any financial decision. Except where liability under any statute cannot be excluded, AMP and our company do not accept any liability for any resulting loss or damage of the reader or any other person. Any links have been provided for information purposes only and will take you to external websites. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.